capital gains tax canada vs us

Get more tips here. 2 File Your Canadian Tax Return.

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

For a Canadian who falls in a 33 marginal.

. 2022 capital gains tax rates. Up to 15 cash back Interested in getting some advice on capital gains. Dollars is US2500.

Since its more than your ACB you have a capital gain. The land - Answered by a verified Canadian Tax. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs.

Professional CPAs finish tax returns and file for you once you review sign. Download 99 Retirement Tips from Fisher Investments. And the tax rate depends on your income.

The sale price minus your ACB is the capital gain that youll need to pay tax on. Property must also be included on your. Canada Corporate Tax Rate vs USA.

When it comes down to it the tax rates. Your sale price 3950- your ACB 13002650. 2021 capital gains tax calculator.

The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital. Any gains or losses from the sale of US. In the United States of America individuals and corporations pay US.

Capital gains taxes on. However that is irrelevant for the. Canada allows capital gains to be taxed at half of the normal tax rate and grants a reduced tax rate on dividends paid by Canadian but not.

Notwithstanding paragraph 1 the taxes existing on March 17 1995 to which the Convention shall apply are. Fill out a questionnaire and upload your tax documentsSTEP 3. If the assets were held for two or more years the gain will be taxed as a capital gain at a 10 flat rate recapture rules are applicable.

Although not directly calculated in the image above the capital gain for this transaction expressed in US. A in the case of Canada the taxes imposed by the Government of Canada. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income.

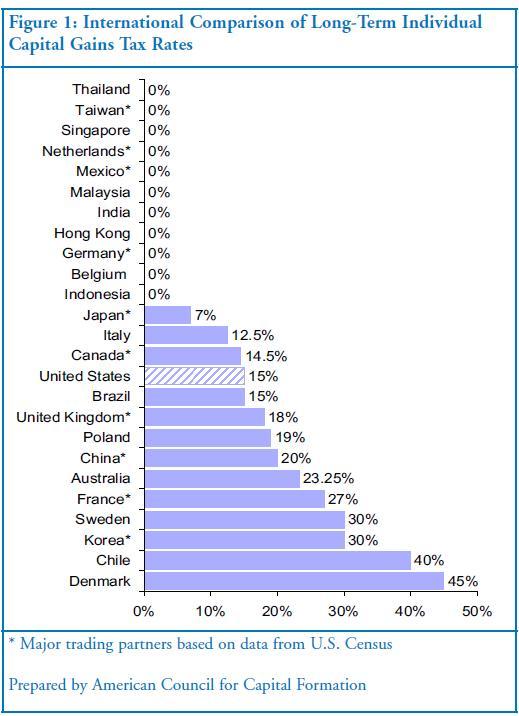

Long-Term Capital Gains Taxes. As a Canadian resident you are subject to tax on your worldwide income. On a capital gain of 50000 for instance only half of that amount 25000 is taxable.

Because you only include one-half of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 446109 half of 892218. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. If you earned a capital gain of 10000 on an investment 5000 of that is taxable.

Comparing the Canada corporate tax rate to the USA is like comparing apples to oranges in many aspects. Ad Tip 40 could help you better understand your retirement income taxes. Colombia Last reviewed 08 August 2022 10.

Included in the will as 500k. Capital gains tax canada vs us. Federal income tax on the net total of all their capital gainsThe tax rate depends on both the investors tax bracket and.

Difference Between Income Tax And Capital Gains Tax Difference Between

Business Capital Gains And Dividends Taxes Tax Foundation

Understanding Capital Gains Tax In Canada

Obama Should Leave The Capital Gains Tax Rate At 15 Seeking Alpha

Capital Gains Tax In Canada Explained

Capital Gains Tax What Is It When Do You Pay It

Calculating Taxable Gains On Share Trading In New Zealand

How High Are Capital Gains Taxes In Your State Tax Foundation

Understanding Taxes And Your Investments

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax Capital Gain Term

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Red China Taxes Capital Relatively Lightly Tax Foundation Tax Capital Gains Tax Countries Of The World

Capital Gains Tax In Canada Explained Youtube

Capital Gains Tax Or Income Tax Which Is Better For You Capital Gains Tax Income Tax Capital Gain