estate tax changes in reconciliation bill

Some of the tax changes include repeals on Trump-era tax cuts for wealthy individuals and corporations such as. Twelve states and Washington DC.

Boldlaws 1464956686371 Png 2166 2791 Keller Williams Real Estate Be Bold Quotes Keller Williams Realty Marketing

Below is a detailed description of important changes to keep in mind as you start using the Philadelphia Tax Center.

. Federal legislative changes reduced the state death tax credit between 2002 and 2004 and ultimately eliminated it effectively eliminating the Colorado estate tax for individuals who die after December 31 2004. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Jobs and Growth Tax Relief Reconciliation Act of 2003 JGTRRA.

Web Upload is a quick and easy way to file and pay employer withholding income tax statements W-21099s sales tax and partnership VK-1 schedules. IRS Publication 600. Tax Relief Unemployment Insurance.

On December 15 Congress also passed an extension of the debt ceiling through the end of 2022 and the annual defense spending bill. IRS Publication 936. Tax Implications of Budget Reconciliation Bill.

Appeal a water bill or water service decision. IRS Publication 600 was. How the Build Back Better Act Could Affect Your Tax Bill Depending on your income the Build Back Better Act recently passed by the House could boost or cut your future tax bills.

Taxpayers can submit their 2021 Wage annual reconciliation on the Philadelphia Tax Center from January 1 2022. Economic Growth and Tax Relief Reconciliation Act of 2001 EGTRRA. The phrase Bush tax cuts refers to changes to the United States tax code passed originally during the presidency of George W.

A document published by the Internal Revenue Service IRS that provides information on deducting state and local sales taxes from federal income tax. Your Philadelphia Tax Identification. In this two-part article we look at the proposed tax law changes in the budget reconciliation bill.

On the Senate side there has been talk of further expansion of corporate deduction limits for executive compensation as well as imposing an excise tax on a company if its CEOs pay exceeds that of an average company worker by a certain ratio. Tax Foundation is Americas leading independent tax policy resource providing trusted nonpartisan tax data research and analysis since 1937. Maryland is the only state to impose both.

The Biden Tax Plan. Impose estate taxes and six impose inheritance taxes. Allows individual taxpayers until April 15 1985 and corporations until March 15 1985 the filing date for calender year returns to pay their full 1984 income tax liabilities without incurring any additions to tax on account of underpayments of estimated tax to the extent that the underpayments are attributable to changes in the law made by the Tax Reform Act of 1984.

Bush and extended during the presidency of Barack Obama through. Mortgage interest deductions are considered itemized. Restoring the estate tax and raising the corporate tax rate from 21 to 26 before.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as estate. Web Upload also accepts Unemployment Insurance Tax Reports FC-20 and FC-21 as supported by. Get Real Estate Tax relief.

3 If federal law is changed to reinstate the state death tax credit a Colorado estate tax may be collected on estates in future years. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. In addition the bill could affect the application of Sec.

On December 11 the Senate Finance Committee released preliminary text for the revised tax changes in the Senates version of the Build Back Better Act BBBA. 4960 by its changes to the corporate income tax rate.

Sales Report Template Free Word Excel Pdf Format Download Monthly Templates Sample Example Sales Report Template Report Template Business Letter Format Example

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Will It Or Wont It Newest Reconciliation Bill Lacks Major Estate Tax Law Changes

Download Free Illustrations Of Vat Value Added Tax Document Magnifying Data Glass Calculate Audit Han Value Added Tax Accounting Services Indirect Tax

Bank Reconciliation Spreadsheet Microsoft Excel Microsoft Excel Account Reconciliation Reconciliation

Everything In The House Democrats Budget Bill The New York Times

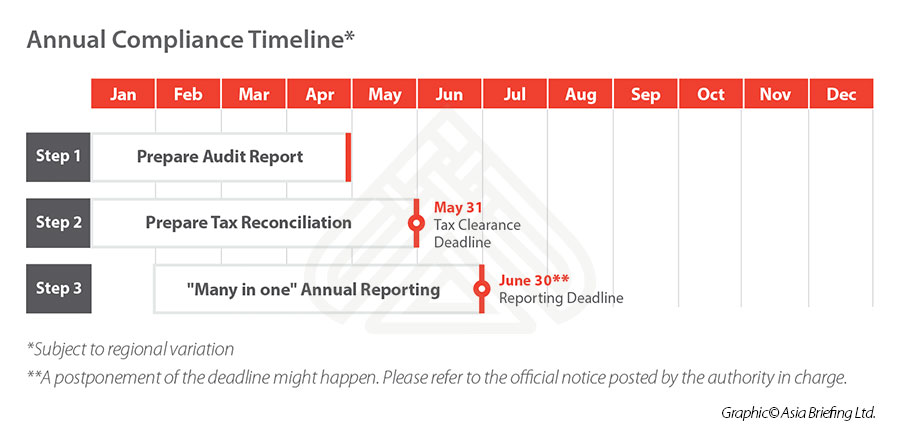

Preparing For Annual Tax Reconciliation In China In 2021 Faqs

Everything In The House Democrats Budget Bill The New York Times

Ai In Financial Services Finance Financial Services Financial Institutions